Tax Transparency

& Fairness in Cashless Economy

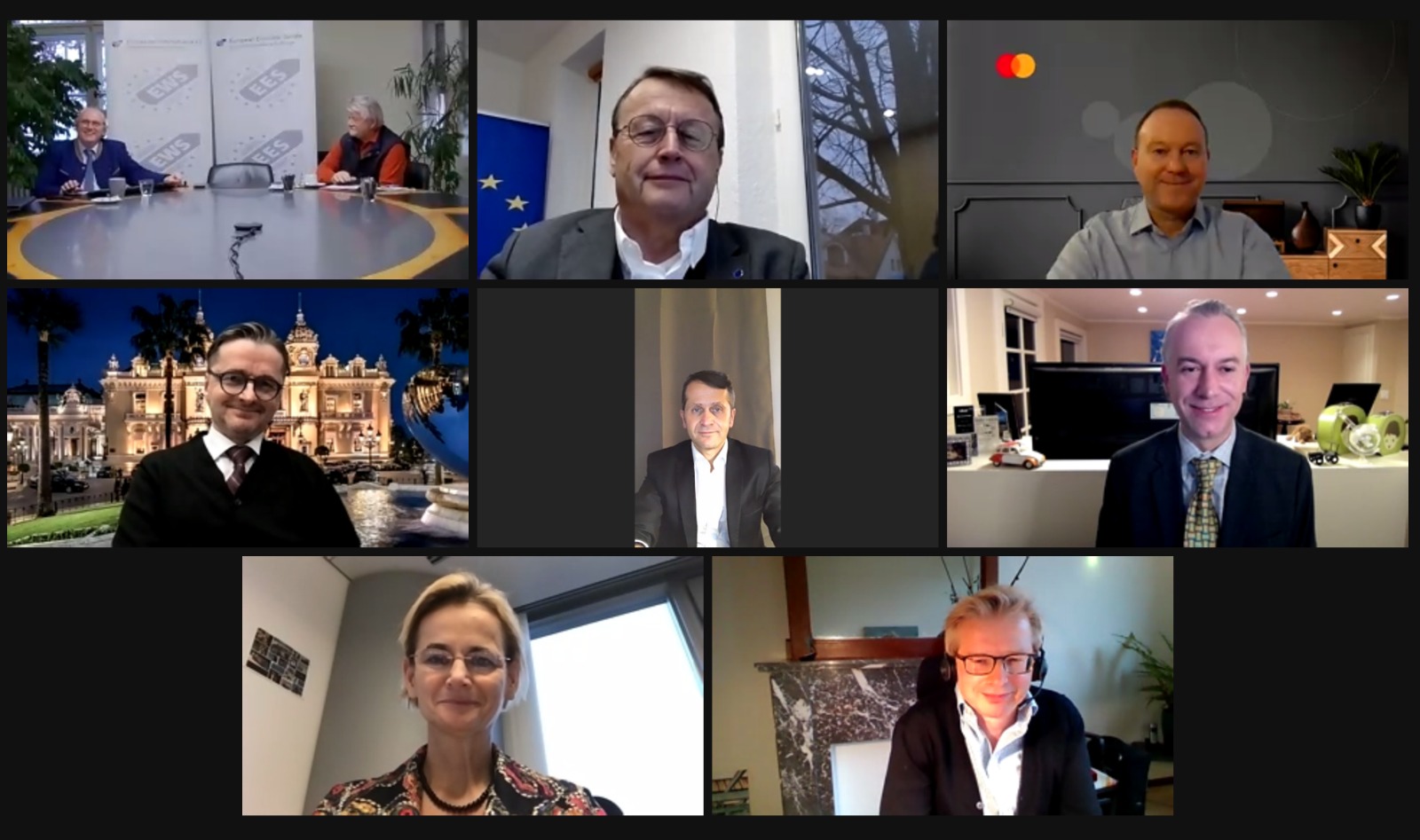

On Wednesday, December 16th, in cooperation with the Taxpayers Association of Europe and the European Economic Senate, SME Connect organized the Webinar “Tax Transparency & Fairness in Cashless Economy” in order to highlight the importance of a sustainable, transparent and fair financial policy and tax system to put a stop to Tax evasion, money laundering and terrorism financing.

Moderated by Michael Jäger, Secretary General, Taxpayers Association of Europe and CEO, European Economic Senate, the webinar featured an opening by Enikö Györi MEP, Member of the ECON, FISC, INTA Committees; and keynotes by Benjamin Angel, Director for Direct Taxation, Tax Coordination, Economic Analysis & Evaluation, DG TAXUD, European Commission and Philp Kerfs, Head of the International Cooperation Unit, OECD. A lively debate followed, with the participation of Thorsten Klein, Vice-President Public Policy, MasterCard, Francois Chadwick, Vice-President Finance, Tax & Accounting, Uber, and Hermann Pamminger, Secretary General, European Casino Association. The webinar was closed by Paul Rübig, MEP (1996-2019), SME Connect’s own President and Member of the European Economic & Social Committee.

In welcoming all attendees, Enikö Györi MEP stressed the importance of reducing bureaucracy and burdens for SME through measures like a binding SME test, in order to guarantee better access to finance and tackle unfair competition on taxation between smaller and bigger businesses.

In the first keynote speech, Benjamin Angel remarked the European Union’s responsibilities towards transparency and fairness. They are not only powerful drivers to fight tax malpractices within Europe itself, but, by “aggressively promoting the international convention and good practices”, the European Union can become a global standard setter in matters of transparency. In the second keynote speech, Philip Kerfs emphasized how the creation of Common Reporting Standards has contributed to creating an exchange framework, especially useful in the case of the gig and platform economy.

As part of the debate, Thorsten Klein focused on how electronic payment can help tackle tax avoidance by levelling the playing field among retailers and combating the shadow economy. Bringing to the table the perspective of the platform economy, Francois Chadwick too highlighted the need for a level playing field for both data sharing and reporting. Lastly, Hermann Pamminger related the issue of the gambling industry: due to the current proliferation of cross-border online actors, part of the grey market, only half of the revenues of the European gaming industry is taxable, with a considerable loss of possible tax revenue for national governments.

To conclude the webinar, Dr. Paul Rübig remarked the different areas in which transparency stands to make a significant difference such as emerging cryptocurrencies and gig economy. Ultimately, he stated, “Europe should come to a position of global leadership in a transparent and fair taxation system.”